Best Cash Back Credit Cards of 2026: Our Top Picks

Cash back remains one of the simplest, most flexible ways to earn rewards on everyday spending. In 2026, you’ll find flat-rate cards that give you a steady 2% or more on all purchases, as well as category cards that boost rewards in dining, groceries, or travel. The challenge is balancing earning power with fees, redemption options, and long-term value. This guide cuts through the noise and highlights the very best cash back credit cards for different spending styles, so you can pick the right set for your wallet.

Whether you want a single card that covers most of your purchases, or a two-card strategy that pairs a flat-rate card with a category-specific powerhouse, the cards in our lineup are chosen for their combination of simple earning, strong bonuses, and flexible redemption. We also explain how to optimize each choice with real-world examples, so you can see exactly how much extra value you could unlock each year.

Why Cash Back Still Wins in 2026

Cash back offers a straightforward, tangible reward: your rewards turn into real money you can use toward balances, travel, or groceries. Compared with points and miles tied to specific programs, cash back gives you more freedom and fewer restrictions. The best cash back cards provide a mix of:

- Strong base earning rates (2% or higher on all purchases)

- High bonus categories with meaningful caps or broad applicability

- Robust redemption options (statement credits, checks, gift cards, or travel credits)

- Solid welcome offers that you can actually reach with typical spending

- Helpful perks and protections like purchase protection, extended warranty, and price protection

How We Chose the Best Cash Back Cards for 2026

We evaluate cards against real-world spending patterns and long-term value. Key factors include:

- Rewards structure – flat-rate vs category multipliers, and how easy it is to maximize earnings

- Annual fee – zero-fee cards vs annual-fee cards with meaningful value

- Signup bonuses – how much you can realistically earn in the first 3–6 months

- Redemption flexibility – can rewards be used to offset any purchase, travel, or bills?

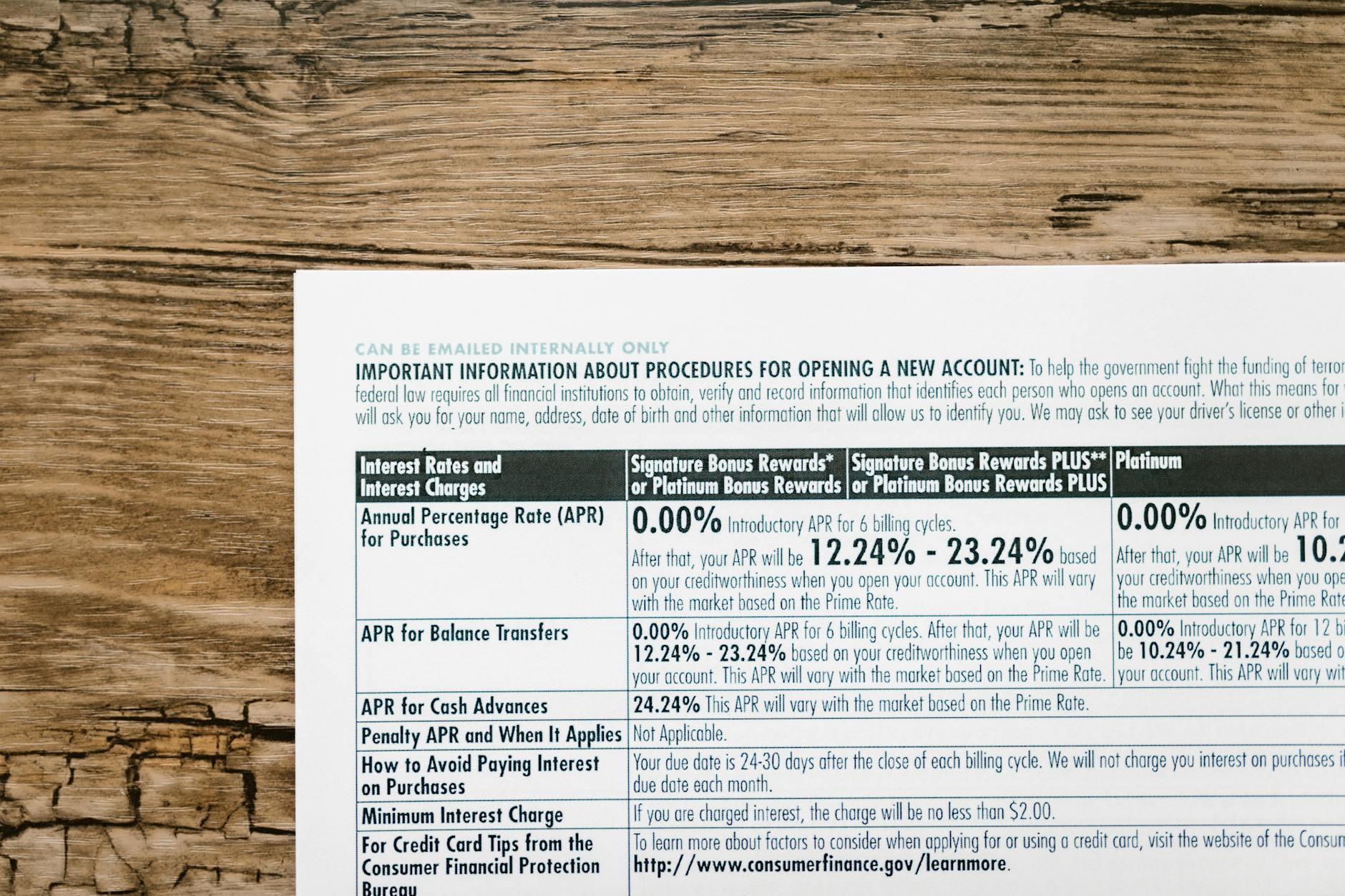

- Intro APR and transfer options – optional, but valuable for big purchases

- Pros and cons – real-world trade-offs like category caps, limited time offers, or complexity

Our Top Picks for 2026

Below are the cards that stand out for most households in 2026. We group them by best use case and explain who should consider each option. Where relevant, we’ve included typical signup bonuses and a note on the annual fee. Offers change, so check current terms before applying.

Chase Freedom Unlimited

The Chase Freedom Unlimited is a robust, all-around performer with a simple earning stack that rewards everyday spenders. It shines for people who want strong dining and travel rewards without juggling complex category rules.

What you earn: 5% back on travel purchased through Chase; 3% back on dining and drugstores; 1.5% back on all other purchases.

Welcome bonus: Commonly around a $200 bonus after meeting a modest spend in 3 months, though terms vary by issuance and time.

Why it’s a top pick: Easy to earn, broad use, and generous travel protection when you book through the Chase network. You also get the solid Chase ecosystem benefits, including transfer options to Chase's partners if you want to diversify later.

Citi Double Cash Card

The Citi Double Cash Card is the ultimate choice for fans of simplicity and efficiency. There’s no annual fee and a single, dependable earnings rate that compounds over time.

What you earn: 2% cash back on every purchase—1% when you buy and 1% as you pay it off.

Welcome bonus: Typically none or modest, but the long-term earning power often surpasses cards with big upfront offers for people who pay their balances in full each month.

Why it’s a top pick: It’s hard to beat the consistent 2% on everything. There are no category caps, no rotating schedules, and no annual fee. It pairs well with a second card that covers dining or groceries for extra value.

Citi Custom Cash Card

The Citi Custom Cash Card is a category-changer: you can earn 5% cash back on your top eligible category each billing cycle, up to $500 spent, then 1% thereafter. It’s a dynamic option for people with shifting spending patterns.

What you earn: 5% cash back on the highest eligible category each billing cycle (up to $500), 1% on all other purchases. Eligible categories include: restaurants, gas stations, grocery stores, select travel, select transit, streaming services, and more.

Welcome bonus: Often a modest sign-up incentive, typical in the range of a few tens of dollars in statement credits after meeting a spend threshold.

Why it’s a top pick: If you can optimize your spend to land a 5% category every cycle, your annual earnings can be substantial without juggling multiple cards. The card automates category selection for you.

American Express Blue Cash Everyday

Amex Blue Cash Everyday is a favorite for households that spend heavily on groceries and online shopping. It emphasizes three high-value 3% categories with a solid base 1% rate on everything else.

What you earn: 3% cash back at U.S. supermarkets (up to a cap per year, then 1%); 3% cash back on U.S. online retail purchases; 3% cash back on U.S. streaming services; 1% on other purchases.

Welcome bonus: Periodically offers a statement credit after meeting a set spend within a few months; terms vary by time and region.

Why it’s a top pick: Great for grocery-heavy households and online shopping, with broad redemption options and no annual fee. The cap on supermarket rewards is important to track, but the card remains a strong everyday option.

U.S. Bank Altitude Go Visa Signature

The Altitude Go is a versatile choice for diners and entertainment lovers who want strong return on daily trips without fuss. It also does a respectable job on groceries.

What you earn: 4% cash back on dining and entertainment; 3% cash back on groceries; 2% cash back on all other eligible purchases.

Welcome bonus: A typical introductory offer of a cash bonus after meeting a spend requirement in the first 3 months.

Why it’s a top pick: A great mix of high-earning dining and entertainment rewards with a straightforward redemption process and no annual fee.

Wells Fargo Active Cash Card

The Wells Fargo Active Cash Card is built for simplicity and steady value. If you want a universal 2% cash back rate with a straightforward welcome bonus, this card is worth a look.

What you earn: 2% unlimited cash back on purchases with no categories, caps, or tracking required.

Welcome bonus: A common welcome offer such as a $200 or similar cash bonus after meeting a spend threshold in 3 months.

Why it’s a top pick: The card earns consistently across all purchases and pairs well with a more specialized card to boost a specific category like groceries or dining.

Capital One SavorOne

Capital One SavorOne is a tasty option for dining, entertainment, and groceries with a modern rewards approach and no annual fee. It’s a practical pick for households that want strong everyday rewards paired with a user-friendly app and solid sign-up offers.

What you earn: 3% cash back on dining; 3% cash back on entertainment; 3% cash back on grocery stores; 3% back on Capital One Entertainment purchases; 3% on everyday purchases—terms apply.

Welcome bonus: A common sign-up bonus like $200 cash back after meeting a spend threshold in 3 months.

Why it’s a top pick: It blends a robust 3% earning baseline in everyday categories with a single, simple redemption path and a strong sign-up offer. No annual fee means immediate value from earned rewards.

Rotating 5% Category Cards (A Note on Discover It)

Rotating category cards can deliver enormous value when you time your spend correctly and activate categories. Discover It is the best-known example with 5% cash back in rotating categories each quarter after activation, up to a quarterly limit. After the cap, you earn 1% on all other purchases. Discover also offers a unique first-year match for new cardholders in many regions, which effectively doubles the return on your purchases in the first year.

Important caveats: You must activate quarters, and category availability changes over time. The spending caps and eligible categories vary, so you need to plan purchases around the calendar and keep an eye on the activation deadlines.

How to Stack and Redeem Your Cash Back Wisely

Maximizing cash back is less about chasing the highest single rate and more about combining cards in a way that matches your spending. A practical strategy is the two-card approach: one flat-rate card and one category-boosting card. This lets you cover broad purchases with a solid base rate while earning more on intentional categories.

- Pairing strategy: Use a flat-rate card (like Citi Double Cash or Wells Fargo Active Cash) for everything you can’t optimize with a category card.

- Category balance: Use dining and groceries with cards that offer the highest returns in those areas (for example, Altitude Go for dining and groceries with strong 4%/3% tiers).

- Redemption flexibility: Prefer cards that offer easy, flexible redemption options—statement credits, gift cards, or direct deposits—so you can actually spend the rewards you earn.

Practical Scenarios: How Much Cash Back Could You Earn?

Let’s walk through a few realistic monthly spend scenarios and estimate potential cash back with our top picks. Note that actual offers and rates change, so treat these as illustrative examples rather than guarantees.

- Household that spends heavily on groceries and dining: Pair Altitude Go (4% dining, 3% groceries) with Citi Double Cash (2% everything). If you spend $900 on groceries and $600 on dining per month, Altitude Go could earn around $45/month (assuming 3% groceries and 4% dining; actual amounts depend on activation and caps). Citi Double Cash adds 2% on everything else, boosting your overall rate.

- Frequent travelers with occasional dining: Use Chase Freedom Unlimited for travel purchased through Chase (5%), plus 3% dining, while using a secondary card for non-travel purchases. If you spend $800/month on travel booked through Chase and $400/month on dining, you could push meaningful rewards quickly.

- Rotating category enthusiast: If you can align purchases with Discover It’s 5% categories, you can significantly boost rewards in max months. During off quarters, the 1% base still earns something rather than nothing.

Real-World Tips to Avoid Common Pitfalls

Even the best cash back cards won’t help if you carry a balance. Interest charges can erase your gains quickly. Here are practical tips to stay ahead:

- Pay in full each month to avoid interest charges that offset your rewards. If you must carry a balance, focus on paying only the minimum on cards with high APRs and prioritize high-reward balances.

- Plan for annual fees and benefits. If a card has a fee, make sure your annual rewards, perks, or credits surpass it.

- Activation is essential for rotating 5% categories. Don’t skip it; set a calendar reminder and check category calendars each quarter.

- Watch caps and limits for category cards. If you go over the cap, you’ll drop to a lower rate, so be mindful of quarterly spending caps and caps on supermarket rewards.

Frequently Asked Questions

What is a cash back credit card?

A cash back credit card earns a percentage of your purchases back as cash rewards. You can usually redeem these rewards as statement credits, direct deposits, or gift cards. The simplest cards offer a straightforward rate on all purchases, while others focus on specific categories like dining or groceries.

Should I get one cash back card or multiple?

Most people do better with a two-card approach: one flat-rate card for general purchases and one category-focused card to maximize dining, groceries, or travel. This setup minimizes effort while maximizing rewards. If your spending is very concentrated in one area, a single category card plus a flat-rate card can still deliver strong value.

Are rotating category cards worth it?

Rotating category cards can offer large rewards in certain quarters but require activation and careful planning. If you’re disciplined about activating categories and timing purchases, you can beat flat-rate cards by a wide margin. If not, a steady 2% or higher with good redemption flexibility may be a safer choice.

How should I use sign-up bonuses responsibly?

Sign-up bonuses are valuable but require meeting minimum spend within a set window. Create a realistic plan to meet the spend without buying unnecessary items. Avoid carrying a balance just to chase a bonus, and consider whether you’ll actually use the card long-term after the welcome period ends.

Conclusion: Pick Your Path to Smart Cash Back in 2026

Whether you’re new to cash back or a seasoned rewards junkie, the best cash back cards of 2026 offer a balanced mix of simplicity, value, and flexibility. Our picks cover a wide range of spending patterns — from the dependable Citi Double Cash to the category-smart Citi Custom Cash, from the grocery-centric Amex Blue Cash Everyday to the versatile Altitude Go and SavorOne. The key is choosing a combination that aligns with your daily routine and redemption preferences. Start with a no-fee card to build momentum, then add a second card to boost your favorite categories. Over time, a disciplined approach to earning and redeeming will yield meaningful, tangible rewards you can use to cover everyday expenses or reduce debt more quickly.

Call to Action

If you’re ready to upgrade your rewards game, start by reviewing the card offers linked in this guide and consider your current spending. Pick a two-card strategy that matches your lifestyle, enroll in activation reminders for rotating categories, and commit to paying balances in full each month. For personalized recommendations tailored to your exact spending pattern, reach out to our team for a quick, free assessment.