How to Choose the Right Credit Card for Your Spending Habits

Choosing a credit card isn’t just about grabbing the biggest sign-up bonus. The real win comes from picking a card that matches the way you spend. When rewards align with your daily uses, you earn more money back and avoid paying for features you won’t use. Below is a practical, step-by-step approach you can apply today.

Step 1 — Map Your Spending Profile

Your spending profile tells you where you should earn the most rewards. It also reveals when annual fees may be worth it. Take a few minutes to categorize your typical monthly costs and estimate dollar amounts for each category:

- Groceries: $350–$800

- Gas: $100–$250

- Dining: $150–$350

- Online shopping: $100–$400

- Travel: $0–$300

- Recurring bills (utilities, streaming, etc.): $250–$600

These ranges will guide you toward cards that reward the right categories. If you spend heavily on groceries, you’ll want a card with strong grocery rewards. If you travel often, a card with solid travel perks may be the winner.

Step 2 — Understand Reward Structures

Credit cards offer different reward structures. Here are the main types you’ll see:

- Flat-rate rewards give the same rate on every purchase, usually 1–2%. They’re simple and predictable.

- Category-based rewards pay higher rates in specific areas (like groceries, dining, or gas).

- Tiered rewards offer variable rates by category and sometimes require meeting minimums or caps.

Choosing between flat-rate and category-based rewards depends on your spend. If you spend a lot in one or two categories, a targeted card often wins. If your spending is spread out, a flat-rate card plus a couple of targeted boosts can work well.

Examples to Consider

Suppose you spend $500 each month on groceries, $200 on dining, and $200 on gas. You’re choosing between two cards:

- Card A: 2% back on everything, no annual fee.

- Card B: 6% back on groceries up to $7,000 per year, 3% on dining, 1% elsewhere, $95 annual fee.

First-year rewards for Card A would be about $120 ($500 groceries + $200 dining + $200 gas = $900 × 2%). Card B would earn grocery rewards of about $36 per month (6% of $500) for groceries, plus 3% on dining ($200 × 3% = $6), plus 1% on gas ($200 × 1% = $2), totaling monthly $48. If you spend $1,200 a year on groceries (6% cap), you reach a higher value after accounting for the annual fee. It’s a quick illustration of why knowing your patterns matters.

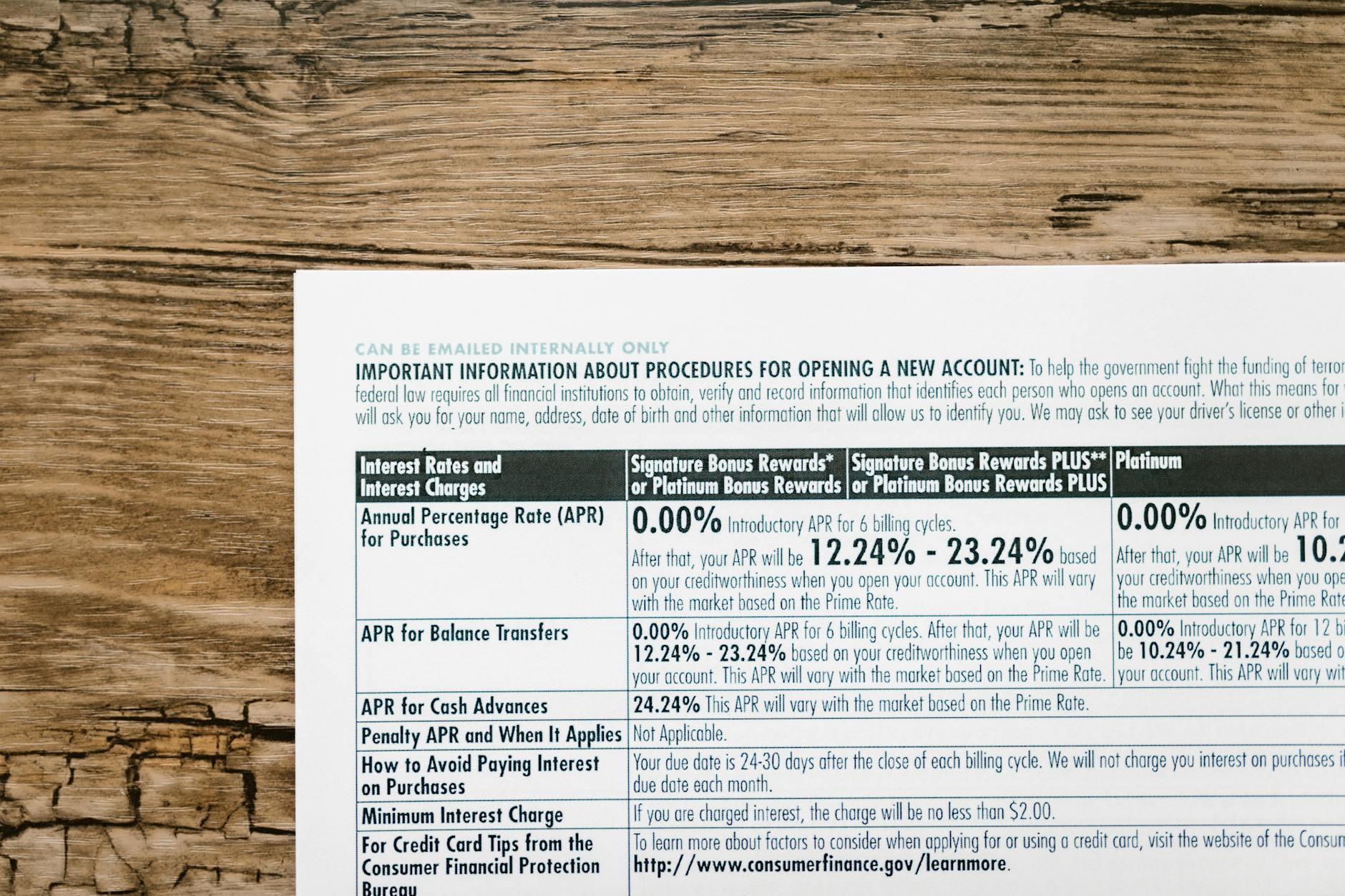

Step 3 — Weigh Costs: Fees, APRs, and Other Charges

Rewards aren’t the only factor. You must weigh costs that eat into value:

- Annual fee can be worth it if your rewards exceed the fee.

- APR matters if you carry a balance. If you pay in full every month, APR is less impactful, but it’s still good to know.

- Foreign transaction fees (usually 0–3%) can add up for travelers.

- Other fees like balance transfer fees, cash advance fees, and penalty APR.

Rule of thumb: only pay an annual fee if you expect to exceed the break-even point within the first year. The break-even point equals the annual fee divided by the monthly net gain from rewards after taxes (roughly your monthly rewards value minus any extra costs).

Step 4 — Check Your Credit Score and Cards You Can Likely Get

Your credit score strongly influences eligibility. Cards are generally grouped from easiest to hardest to obtain as follows:

- Entry-level cards for starter or rebuilding scores

- Everyday cards for good scores (typically 670–740)

- Premium cards for excellent scores (740+)

Before applying, consider:

- How many open inquiries you’re comfortable with in a short period (too many can lower your score).

- Whether you want to try pre-qualification, which often doesn’t affect your score.

- Your recent payment history and debt-to-income balance, which lenders review.

Pro tip: use pre-qualification tools from issuers’ sites. They ask for minimal information and won’t always impact your credit score. If you’re rebuilding, start with a secured card or a co-signed account to rebuild.)

Step 5 — A Simple Formula to Compare Cards

Use a straightforward, numbers-first approach. Here’s a practical way to compare cards:

- Estimate your annual spend by category: groceries, gas, dining, travel, online shopping, and others.

- Apply each card’s reward rate to the corresponding spends, capping category rewards if there is a cap (e.g., groceries up to certain dollars).

- Subtract annual fee (if any) from the total annual rewards.

- Assess other fees (foreign transactions, balance transfers, etc.) and any limits on rewards.

- Choose the card with the highest net annual reward value for your spend profile.

Let’s illustrate with a two-card example:

- Card A: 2% flat on all purchases, no annual fee.

- Card B: 3% on groceries up to $6,000/year, 2% on all other purchases, $95 annual fee.

If you spend $8,000 per year on groceries and $10,000 elsewhere, Card B would earn groceries: $6,000 × 3% = $180, then $2,000 × 2% = $40, total $220, minus the $95 fee equals $125 net. Card A would earn $18,000 × 2% = $360. In this case Card A pays off for you, unless your grocery spend hits the $6,000 cap and you value the travel or other perks from Card B more.

Step 6 — Real-Life Scenarios: Making It Concrete

Case studies help you visualize outcomes. Here are two realistic examples:

Scenario A — The Groceries and Dining Spender

Monthly spend: groceries $600, dining $350, gas $150, online shopping $350, all other $300. Annual spend totals: groceries $7,200, dining $4,200, gas $1,800, online $4,200, other $3,600.

Card X (no annual fee): 2% everywhere. Annual rewards: 0.02 × (7,200+4,200+1,800+4,200+3,600) = 0.02 × 21,000 = $420.

Card Y (annual fee $95): 5% groceries up to $6,000/year, 3% dining, 2% other. Rewards: groceries 6,000 × 5% = $300; dining 4,200 × 3% = $126; other 11,800 × 2% = $236; total $662; minus $95 ≈ $567 net. Card Y wins for this profile.

Scenario B — The Traveler

Monthly spend: airfare $400, hotels $350, local dining $200, everyday purchases $600. Card A (flat 2% on everything, no annual fee) earns $1,400 × 2% = $28 per month, or $336 per year. Card B offers 3% on travel and 2% on everything else with a $95 annual fee. Annual travel spend: $4,800. Rewards: $144 on travel, plus $2,400 × 2% = $48; total $192; minus $95 = $97 net. Card A beats Card B for this pattern unless travel benefits are exceptionally valuable to you.

Step 7 — Common Mistakes and How to Avoid Them

- Chasing big bonuses without considering ongoing rewards or fees.

- Ignoring category spending and ending up with a card that doesn’t fit your routine.

- Carrying a balance on a high-interest card; rewards won’t offset interest charges.

- Applying for too many cards in a short period, which can hurt your credit score.

Putting It All Together: Your Personal Card Plan

Here’s a simple plan you can adapt today:

- Track 90 days of spending in key categories and note any seasonal spikes (like holidays or back-to-school time).

- Determine your top two spend categories and estimate annual spend in each.

- Choose one card that maximizes rewards in your top category and one flexible card with solid rewards for everything else.

- Compute break-even: annual fee minus (monthly rewards × 12). If negative, a net gain, otherwise reconsider.

- Check for pre-qualification offers to minimize hard inquiries.

Sample plan for a grocery-d or dining-heavy spender: pick a grocery-optimized card with a high rate up to a cap plus a second card for everything else, and keep an eye on total annual costs.

FAQ — Quick Answers to Common Questions

Q: What is the best way to compare credit cards?

A: Start with your spending profile, compare rewards by category, factor in annual fees and APR, and run a simple rewards calculator using your numbers. Use pre-qualification tools to test eligibility without harming your score.

Q: Should I apply if my credit score is average?

A: Yes, but manage expectations. You’ll likely qualify for a broad set of cards with lower annual fees and decent rewards. If possible, start with a secured or student card or a card designed for building credit.

Q: How do annual fees affect rewards?

A: Annual fees can be worth it if your rewards exceed the cost. A card with a $95 annual fee may be a good deal if you earn more than $1,000 in value from rewards annually after factoring in any travel credits or insurance perks.

Q: What happens if I carry a balance?

A: If you carry a balance, interest charges can wipe out rewards. Look for a card with a lower APR or a 0% intro APR on purchases to reduce costs while you pay down debt.

Conclusion: Your Path to Smarter Card Choices

Choosing the right credit card is about matching rewards to your actual spending. It’s not just about the biggest bonus—it's about ongoing value. Start by mapping your spending, understanding reward structures, weighing costs, and using a simple comparison formula. With a clear plan, you can pick a card that fits your life, helps you save, and supports healthier finances over time.

Call to Action

Ready to take the next step? Use the steps outlined to build your personalized card profile, and consider checking pre-qualified offers from major issuers today. For more personalized guidance, subscribe to our free newsletter and get monthly tips on maximizing credit card rewards while staying debt-free.