Understanding APR, Annual Fees, and Credit Card Fine Print

When you look at a credit card, you may focus on rewards or the color of the card design. But the real cost often hides in three things that most beginners overlook: the APR, the annual fee, and the fine print that comes with every offer. These elements can change how much you pay over time and can determine whether a card is a good fit for your finances. This guide explains each piece in plain language, with real-world examples, so you can compare offers confidently and avoid costly surprises.

Understanding APR: The Real Cost of Borrowing

What APR means on a credit card

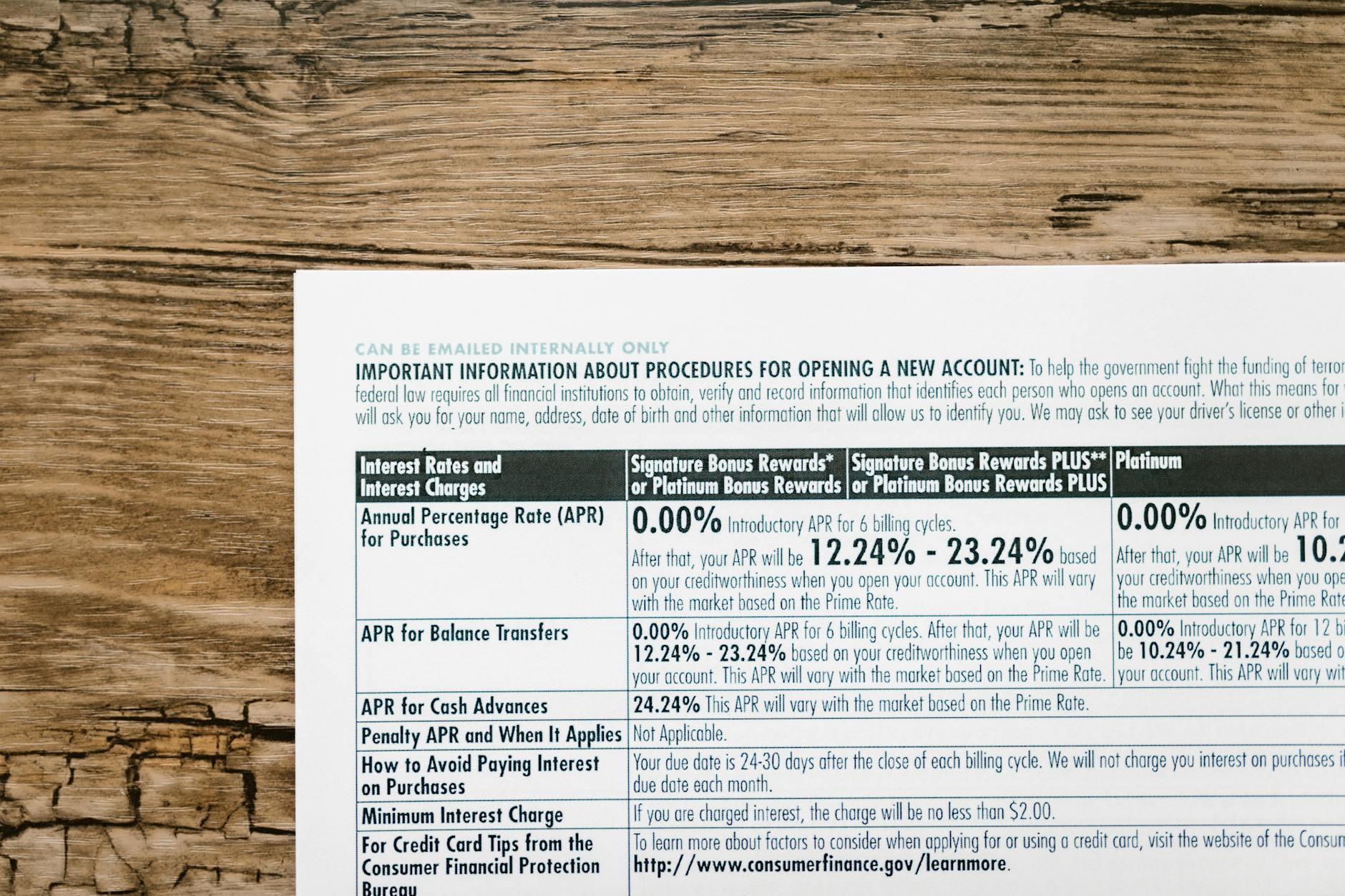

APR stands for annual percentage rate. On a credit card, the APR tells you how much interest you’ll pay each year if you carry a balance. It is not the total amount you’ll owe, but it is the number that determines the interest charged on purchases, balance transfers, and cash advances when you do not pay your statement balance in full.

Important: there are separate APRs for different activities. A card can have a Purchase APR, Balance Transfer APR, and Cash Advance APR. Some cards also offer a Penalty APR if you miss payments. The APR you see on an offer is usually the rate for purchases, but you may see other rates for other actions.

How APR is calculated in practice

Most credit card issuers calculate interest using a daily periodic rate, which is the annual percentage rate divided by 365. If your APR for purchases is 18.99%, the daily rate is roughly 0.052% per day. Here’s a simple example:

- Balance: $2,000

- Purchase APR: 18.99%

- Daily rate: ~0.052% (0.1899 / 365)

If you carry a balance, interest accrues each day. Over a 30-day cycle, simple math suggests about $31–32 in interest for a $2,000 balance, but actual interest depends on daily balances and how the issuer compounds. The bottom line: higher APRs cost more over time if you don’t pay in full each month.

Types of APR you’ll see

Credit cards can carry different rates for different activities. Here are the common types you’ll encounter:

- Purchase APR: Interest on everyday purchases.

- Balance Transfer APR: Interest on balances moved from another card. This is often offered as a promotional rate for a limited time.

- Cash Advance APR: Usually higher than purchase APR. Interest starts immediately and there is no grace period.

- Penalty APR: A higher rate triggered by late or missed payments. It can stay in effect for a period after you return to on-time payments.

- Introductory or 0 APR offers: Temporary low or 0 APR on purchases or balance transfers. These end after a set period and your rate can jump to the standard APR.

How to compare APR across cards

Don’t compare offers by reading only the headline APR. Here’s how to make a smarter comparison:

- Look at the Purchase APR and the Balance Transfer APR if you plan to transfer a balance.

- Check the Cash Advance APR in case you need cash advances.

- Note the Intro APR period and what happens after it ends.

- Ask about the Penalty APR terms and how to avoid triggering it.

Real-world example: You’re choosing between Card A with a Purchase APR of 16.99% and Card B with a Purchase APR of 19.99%. If you carry a $3,000 balance for a year, Card A costs about $510 in interest, while Card B costs about $570. The difference might be more noticeable if you carry a larger balance or if you routinely carry balances over multiple statement cycles.

Intro APR offers: good or not?

Intro APR offers can save you money if you have a plan to pay off a balance before the promotional period ends. But be careful: once the promo ends, the rate can jump to a high standard APR, sometimes 25% or more. Read the terms: length of the promo, what balances qualify, and how the rate is applied after the promo ends.

Understanding Annual Fees

What an annual fee means for your wallet

Some cards charge an annual fee, usually once a year, just for having the card. The fee can range from around $0 to well over $500 for premium travel cards. A no-annual-fee card may seem like the safer option, but an annual fee card can be worth it if the benefits and rewards exceed the cost.

When a fee is worth paying

Use cases where an annual fee card can be a good deal include high recurring benefits, large signup bonuses, and perks you actually use. For example, a card with a $95 annual fee might offer:

- 2x or 3x on common spend categories like groceries or gas

- Travel credits or lounge access

- Extended warranty, purchase protection, or rental car insurance

- Sign-up bonus worth more than the annual fee in the first year

Real-world example: A card with a $95 annual fee might grant $1,000 in annual statement credits, 3x on groceries, and a generous return protection. If you spend $3,500 on groceries and travel per year and max out the rewards in those categories, you could easily surpass the $95 fee in value.

No-annual-fee cards can still offer solid value

Many no-annual-fee cards pair competitive purchase rewards with useful protections. The trade-off is often fewer premium perks and lower sign-up bonuses. If you’re a light-to-moderate spender or want a secondary card for specific categories, a no-fee option can be the smarter choice.

How to decide if you should pay an annual fee

Follow a simple check list:

- Do you spend in the card’s strong reward categories often enough to generate rewards well above the fee?

- Will you use the exclusive benefits, such as lounge access, travel credits, or rental car insurance?

- Can you reach the signup bonus? If the bonus value substantially exceeds the fee in the first year, that helps.

- Is there room in your budget for the assurance the card provides, such as enhanced protections?

Remember, the right choice depends on your spending patterns and life goals. A premium travel card may be ideal for a frequent flyer, while a no-fee card can suit someone who rarely travels.

Reading the Fine Print: The Terms that Matter

Grace period and paying on time

A grace period is the time you have to pay your balance in full without incurring interest on new purchases. Most cards offer a grace period of 21 to 25 days after the billing cycle ends. If you carry a balance, you may lose this grace period and pay interest from the purchase date.

Fees to watch in the fine print

Common and sometimes sneaky fees to watch for include:

- Late payment fees and the possibility of a penalty APR if you miss a payment.

- Balance transfer fees, typically a fixed percentage of the amount moved.

- Cash advance fees, plus higher APRs with no grace period.

- Foreign transaction fees, which apply when you use the card abroad or on international merchants.

- Over-limit fees and other miscellaneous charges for going beyond your limit.

Penalty APRs and how to avoid them

Penalty APRs are harsh increases in your rate after late payments. They can push the rate up dramatically and stay in effect for months. To avoid penalty APRs, set up autopay for at least the minimum payment and keep an emergency buffer so you’re not tempted to miss a payment.

Understanding rewards language and redemption rules

Fine print also covers how you earn and redeem rewards. Look for:

- Which categories earn the highest rate and when they apply

- Minimum redemption amounts and whether rewards expire

- Restrictions on redeeming for cash, credits, or travel

- How often rewards programs can change terms or point values

How terms can change over time

Issuers can change APRs, fees, and even reward structures. They typically must provide a notice period, but the exact rules vary by state and product. It’s wise to review your card’s terms at least once a year and after any major life change that affects your credit behavior.

Smart Card Strategy: Practical Steps to Save Money

Begin with a spending plan

Create a simple monthly plan that matches your spending with card rewards. For example, if you spend more on groceries and gas, look for cards that maximize those categories. Track spend with a budgeting app or a free spreadsheet to see how much you earn back after paying the annual fee (if any).

Pay in full when you can

Paying the full statement balance by the due date means you avoid interest on purchases. This is the simplest way to lower the true cost of using a credit card. If you can’t pay in full, aim to pay more than the minimum to reduce interest quickly.

Balance transfers and timing

If you’re consolidating debt, a balance transfer can help, but watch for transfer fees and the duration of the promotional APR. Plan the payoff schedule to finish before the promo ends to maximize savings.

Manage fees by design

Look for cards that minimize fees you’re likely to incur, such as foreign transaction fees if you travel, or annual fees if you don’t use the perks enough to justify them. Consider setting alerts for due dates and balance thresholds to avoid accidental overages.

Real-World Scenarios: How APR and Fees Play Out

Scenario 1: You carry a balance on a card with a 15.99% APR and no annual fee. You owe $1,500 at the end of the cycle. If you pay only the minimum, interest will accrue and you may pay hundreds more over the year. If you can pay $1,000 within each month and keep the balance under control, you reduce interest drastically.

Scenario 2: You are considering a premium travel card with a $95 annual fee and strong lounge access plus category bonus rewards. If you spend $6,000 per year across travel and dining, and you value lounge access and credits, you may come out ahead after accounting for rewards and credits even after the fee.

Scenario 3: You want to transfer a large balance. A card might offer a 0 APR for 18 months with a 3% transfer fee. If you expect a fast payoff, this can save money, but you must avoid a high post promo APR and the transfer fee if your payoff plan slips.

Frequently Asked Questions

Q: What is the difference between APR and the interest rate I see on a card offer?

A: APR is the annual rate used to calculate interest over a year. The card’s quoted rate is often the Purchase APR. Other rates may apply for different actions, like cash advances or balance transfers. APR is the yearly rate; the daily periodic rate determines daily interest.

Q: Do annual fees always mean higher costs?

A: Not necessarily. An annual fee can be worth it if the card delivers enough rewards, credits, protections, and bonuses that exceed the fee. Do the math: estimate yearly rewards and credits minus the annual fee to gauge value.

Q: How can I avoid paying high fees or penalty APRs?

A: Pay on time every month, set up autopay for at least the minimum, and avoid cash advances unless necessary. Read the fine print to understand when penalty APRs apply and how to avoid them.

Q: What should I look for when comparing APR and annual fees?

A: Compare the Purchase APRs, intro offers, and the exact annual fee. Then assess rewards in your typical spending categories, any signup bonuses, and how long the perks last. Don’t forget to review fees like foreign transactions and balance transfer costs.

Conclusion: Make Smart Choices with APR, Fees, and Fine Print

Understanding APR, annual fees, and credit card fine print isn’t about math for math’s sake; it’s about making informed choices that fit your money goals. APR tells you how costly it is to carry a balance, annual fees show up as a fixed yearly cost unless offset by rewards and credits, and the fine print reveals the rules that can quietly change the true cost of ownership. By comparing offers with a clear checklist, calculating potential rewards, and avoiding common traps, you can choose cards that genuinely save you money over time.

Looking for more guidance? Compare top cards side by side, read real-world user experiences, or talk to a financial advisor who can help tailor recommendations to your situation. The goal is simple: minimize cost while maximizing value.

Call to Action

If you are ready to compare credit cards with APR, annual fees, and fine print in mind, start with our free comparison tool. It helps you filter by your spending habits, preferred perks, and whether you want to avoid annual fees. Take control of your credit card costs today and choose a card that truly fits your finances.